The recent SaaS index plunge reminded me of Brave New World. It depicts a society engineered for comfort, stability, and manufactured belief. John, our protagonist, grows up in a remote tribe untouched by the modern system—he's raised on disease, religion, and Shakespeare. Upon being brought to London, the clash destroys him. He spirals into self-punishment, violence, and suicide.

The typical takeaway is: humanity gets crushed by the post-modern world. But given everything happening in tech right now, I'd like to offer a different take: you don't want to be John.

Our read of SaaSpocalypse

The premise: Foundation models enable AI agents that can automate human workflows. The effects:

- Build internally: Companies can build their own custom agents or use ones provided by the models. Agents can use SaaS products (reducing seats) or directly perform the function (weaning off vendors).

- Vendor compression: Point solutions and general offerings from CRM, data enrichment, and workflow giants become vulnerable to data moat erosion and price undercutting from LLMs and modern/open-source disruptors.

- Traditional SaaS strategy is deprecated: Seat-based pricing, systems designed to be used by human workers, and value props rooted in functionality are all incompatible with agents that directly drive business outcomes (side note: this reminds me of the advertising shift from impressions and clicks → intent → conversion).

- Not all SaaS is equally exposed: Vertical solutions with proprietary/full-stack data loops (Toast, Procore) or deep regulatory moats (Veeva) are defensible because agents can't easily replicate domain-specific workflows. Core infrastructure systems that support agents (Databricks, Snowflake) may even benefit.

Why this matters to you

The market has spoken on AI agents. Nonetheless, folks are taking sides and both sides are loud. Amid the chaos, it may be difficult to evaluate what an agentic economy means for your firm, how you can benefit from it, and how you can get there. I want to focus on financial services and present some thoughts on:

- What agentic finance looks like

- What role do companies like Debreu play in the new world?

- Why LLMs won't eat our lunch

1. The Future of Financial Services Front-Office

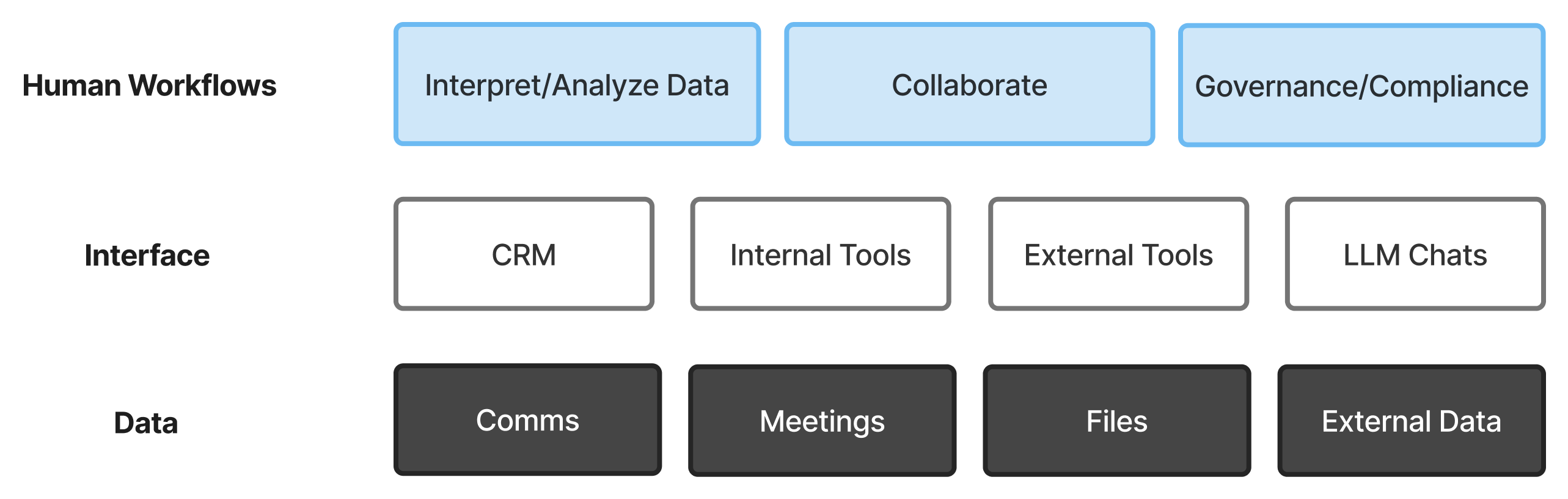

Here's the work stack today:

The system of record exposes data to human workers, who use it to perform business functions. LLMs are now used to assist workflows, but do not yet directly drive outcomes end-to-end. Three underpinning premises not explicitly laid out in the diagram are:

- The data layer today is mostly raw, incomplete, and often low-quality (read about our view of the ideal state of financial services enterprise data).

- Context across different interfaces (email, files, CRM, LLMs, market data providers) is not coordinated. People have to stitch together the truth and are unable to fully trust any single source.

- Running manual workflows on top of fragmented data means that human bandwidth, error margins, and communication overhead are limiting factors, even with the best talent.

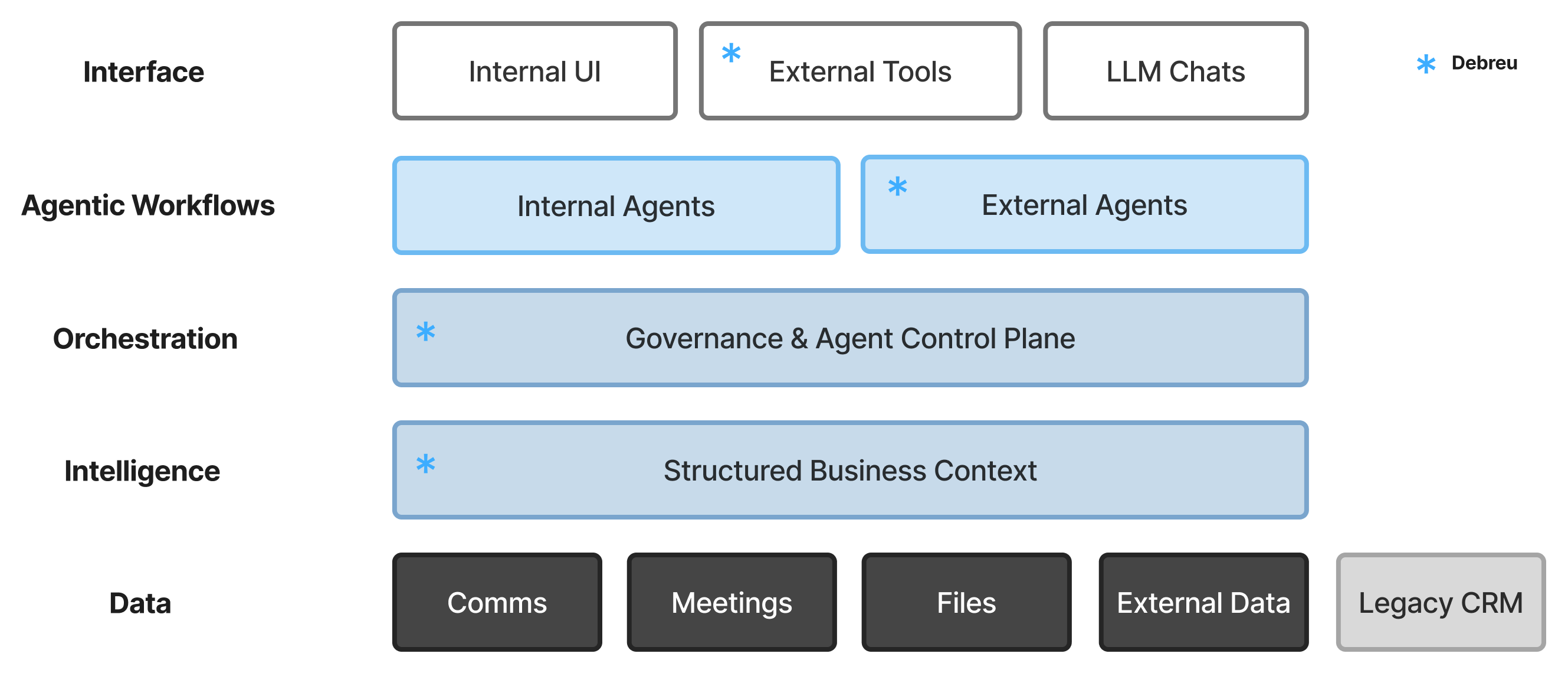

Now here's our rendering of the future stack (inspired by OpenAI Frontier):

Notable changes:

- Interface above workflows: Workflows are now executed by agents instead of humans; humans input goals and monitor/intervene.

- Orchestration layer: This layer tells agents what data they can and should fetch for each task and defines agent behavior. It establishes precise security controls and defines a standard protocol for connecting to a rich (and growing) ecosystem of modern solutions. Put another way, this is the infrastructure that enables fine-tuned agent performance and lets teams easily 1) build internal agents in a low/no-code manner and 2) test out new third-party solutions without incurring integration costs or increasing risk surface.

- Intelligence layer: This level centralizes and standardizes business context – ingests raw data from various channels, validates and normalizes it, and assigns it meaning and traceability. Structured data is key for agents (and humans) to assess and complete tasks without hallucinating or running into context limits. The data schema should be easily configurable to your business and systems.

- System of record: Note that in this world, traditional systems of record (e.g., CRMs) are relegated to the same status as any other source of raw data. They remain useful as record-keeping infrastructure, but they are not the intelligence layer (case in point: aggressive branding efforts like "Agentforce" and "CRMx").

2. Where Debreu Fits In

At Debreu, we are building the Intelligence and Orchestration platform for financial institutions, enabling customers to seamlessly adopt agentic systems without rebuilding their infrastructure. We also provide domain-specific workflows across CIB/S&T/PE for use out-of-the-box. A bit more color on these points:

The Platform

This is Debreu's core offering. We enrich, clean, and persist your data, and provide the infra for safely adding new product integrations while ensuring agent behavior does not suffer from inaccurate or incomplete data or context.

- Combining the Intelligence/Orchestration layers is essential. It enables you to both access and control all data points: primary, derived, or enriched. Clean, MCP-backed APIs for agents mean any data reads are targeted and intentional, which is a win-win—you control what others see, and AI tools get the exact context they need.

Want to use Debreu's workflow agents, other products, or build your own? Do it easily and compliantly.

Data Schema

At the foundation of Debreu's platform is a domain-specific, fully-configurable data schema. All data (internal and external) gets mapped to a personalized spec. Your intelligence layer should understand properties specific to your needs (e.g. healthcare vs. tech, debt vs. equity) at a granular level (firm, business line, team).

Intelligence is built into the schema. Beyond primary fields (e.g., company/people/projects), the schema captures derived context (e.g., sentiments, signals, relationships between entities, and how they evolve over time) that's traceable to the source.

Workflows

- Tailored and proactive workflows. We believe you need both. Tailored workflows that are not proactive rely on repeated human prompting. Proactive automations that don't understand your context and goals just generate noise.

- Examples we've built out: outreach initiation and tracking, action item identification, target list generation, meeting prep, deal management.

That leads us to the next question: "even if Debreu can do all this, why wouldn't I wait for GPT or Claude to build it?"

3. Existential Crises

Foundation model companies (Anthropic, OpenAI, Google) are going "product-mode". The B2B landscape looks like an open feast. Can AI finance startups survive? How should financial institutions determine whether vendors are worth starting contracts with? (More on this to come in a later post.)

Here are three reasons why we believe we'll survive and thrive:

Infrastructure, not feature

Debreu is an infrastructure platform for all your workstreams and data. We turn your institutional knowledge into a self-compounding asset. AI is simply one of many tools for us to serve our users, not the core product.

Until OpenAI becomes Skynet, your modern stack will comprise many layers, not just a single AI app. Processes and agents depend on a reliable, structured substrate.

Domain Specificity

Even if LLMs cater to "finance", they need opinionated, finance-native ontologies, entity relationships, and signal taxonomies built into the schema to effectively serve users and agents; these opinions should be aligned with your specific industry, business-line, and team. If a CFO emails me "we're evaluating our options", a system with last-mile domain expertise knows exactly what additional context to search for, how to interpret it, and can differentiate between live deal signal and routine commentary.

In financial services, intelligence lives in nuance, and the cost of a wrong interpretation isn't just wasted time; it's a lost mandate.

Model-Agnosticism

LLMs are in a tight and ever-fluctuating race. You shouldn't need to constantly pick winners or bet your intelligence infrastructure on a single provider's roadmap.

We've seen massive gaps in effectiveness at both the provider and model level on different aspects of tasks. That's why we use a variety of models, and constantly refine our composition based on new releases, fine-tuning with our internal test data, and user feedback. Debreu handles model volatility. You focus on getting mandates and doing deals.

Back to John

Whether you're a financial services company or an AI SaaS startup, we believe now is a watershed moment to think about how your work stack can adapt to the future (i.e. the next couple years).

John spent his last days whipping himself in an abandoned lighthouse. Putting romance aside, John's downfall wasn't that the new world was inherently bad; it's that he had no framework for operating in it. While this isn't the greatest analogy, you certainly don't want to wake up in a year and realize your wallet share has been eaten away by competitors using agents that have delivered faster, charged less, and expanded ruthlessly.

The future we've painted may seem distant (or is it?). Decisions today, however, matter because agents will bring about an exponential step in cost-efficiency and productivity (and humans are bad at exponential forecasting). Every contract refresh, every new vendor evaluation, every internal project today plays a role in whether your firm will benefit from compounding efficiency drivers or turn to stone.

On the flip side, this is also a great opportunity. There are so many AI solutions that companies can use to configure their "ideal" agentic work stack. The decision tree is massive and complex. My co-founder Lucy, who has firsthand experience evaluating AI vendors for a bank, is releasing a framework for financial institutions to set themselves up for success in the agentic new world—stay tuned.