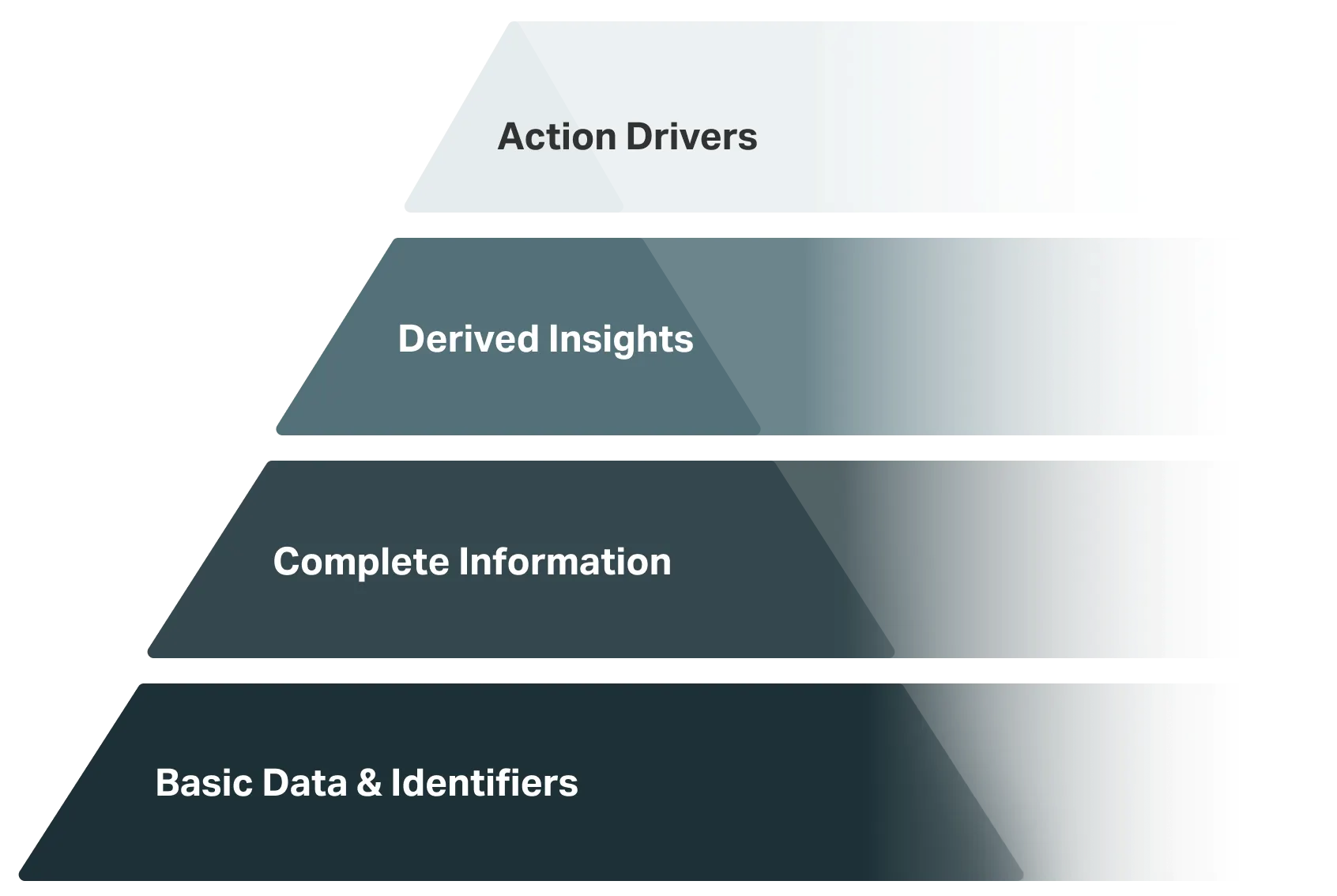

I was recently chatting with a friend and fellow founder who re-interpreted Maslow's hierarchy of needs for enterprise data (fun fact: Maslow didn't come up with the pyramid). I wanted to share some thoughts on how this applies to financial services.

The key assumptions:

- Each level is only achievable by completing the levels below

- Levels progressively yield stronger outcomes and are worth pursuing

- The top level is aligned with top-level personal/firm-wide goals

Why we're talking about pyramids

We started Debreu with a clear goal: Help financial institutions turn their own data into a durable growth advantage.

To do this, we quickly realized institutional knowledge is key and we needed to deeply understand users' data. Three axes we've used to segment data are: type, source, and quality:

- Type: core CRM data models (companies, people, interactions, files, notes, …), interpretation/intelligence layer (e.g. themes, sentiments, signals, analyses), orchestration/compliance layer (deal/pipeline management, reporting, auditing)

- Source: internal sources (emails, meetings, files), external databases, public data, and LLM-enrichments (for interpretations and analyses)

- Quality: correctness, completeness, usability.

Every datapoint you see, use, and store today falls onto different places along these axes, and their holistic effect is key to your and your firm's bottom-line success (deals). Financial institutions use a combination of internal and external tools to capture data, but results are incomplete, unharmonious, and expensive. The adapted Maslow's hierarchy provides a clean lens through which we can identify gaps in origination efficiency and evaluate data-driven solutions.

Why this matters for you

AI is here and it's not stopping–we can all agree on that. The question is: how can financial institutions use technology to generate more returns? The raw answer: your data is your IP. Useful data and effective access to it puts you in a better position to initiate conversations, win mandates, and foster relationships, while also reducing human error and operational overhead.

If you're reading this, you're likely already evaluating solutions: gen-AI models, tools built on top of them, and in-house products. The challenge is: will these tools actually reduce friction, yield concrete results, and support long-term business goals? We believe that the most important factor is how any solution sources, augments, and leverages data.

Back to the pyramid

Our version of the data hierarchy is as follows:

| Level | What this means & examples | Why is this important |

|---|---|---|

| 1) Organizational Data | Your interactions. Ex: Emails, meeting notes, teams messages. |

Garbage in, garbage out. No AI tool can produce results if the underlying data is insufficient. Any good solution should automatically ingest from communication channels and file systems while filtering out noise. |

| 2) External Data | Consolidation of your interaction data, alongside 3P hydration. Ex: Companies, connections to companies. |

External/public data should seamlessly complement internal records. |

| 3) Derived Insights | Structured representations of your data that directly support your workflows. Ex: Themes, sentiments, signals, intel… |

Raw data sitting in a CRM is worthless to both humans and machines. The real work is parsing unstructured communication into clean, standardized intelligence that users can read and systems can query. |

| 4) Action Drivers | System understands intents and business goals. It acts as a proactive partner in ideation, targeting, communication, follow-through and execution. Ex: Auto-generated target suggestions, meeting prep and public news, outreach tracking. |

Turns institutional knowledge into firm-wide advantage: surfacing insights, improving judgment, and driving execution. |

Each layer compounds. Outcomes of workflow solutions are constrained by the quality of core data. Hooking up different products at each layer is costly and burdensome; they end up being glued together by human memory, effort, and time. As firms look toward the future and AI continues to redefine what is possible, we hope this is a useful framework for evaluating origination solutions.

A shameless plug to finish

We've spoken to dozens of advisory firms; they've told us that their setup for levels 1 and 2 is fragmented, incomplete, and cumbersome, resulting in low-adoption. For levels 3 and 4 (insights and action drivers), tech hasn't provided any systematic approaches to origination at all! Most are focused on junior efficiency or generic chatbots (more to come on this point in a separate article).

Debreu is the full-stack solution to drive growth for financial institutions. Please reach out to [email protected] if you want to try our product, learn more, or have any comments.